Introduction to the Federal Reserve’s Role

Understanding the Federal Reserve System

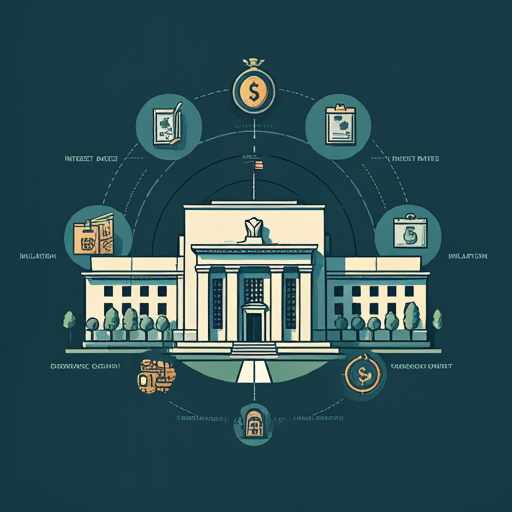

The Federal Reserve, established in 1913, serves as the central bank of the United States . Its primary role is to manage monetary policy, ensuring economic stability. This institution influences interest rates and regulates the money supply. By doing so, it aims to promote maximum employment and stable prices.

Key functions include:

These actions directly impact inflation and economic growth. He understands that a stable economy fosters confidence. The Federal Reserve also acts as a lender of last resort during financial crises. This role is crucial for maintaining liquidity in the banking system.

In summary, the Federal Reserve plays a vital role in the U.S. economy. Its decisions affect everyone.

The Importance of Monetary Policy

Monetary policy is crucial for economic stability. It influences inflation and employment levels. By adjusting interest rates, the Federal Reserve can stimulate or cool down the economy. This mechanism is vital for managing economic cycles.

Key tools include:

These tools help control the money supply. He recognizes that effective monetary policy fosters growth. It also mitigates the risks of recession. Understanding these dynamics is essential for investors. Economic health impacts investment decisions significantly.

Key Components of Monetary Policy

Interest Rates and Their Impact

Interest rates are a fundamental component of monetary policy. They directly influence borrowing costs for consumers and businesses. Lower interest rates encourage spending and investment. This can stimulate economic growth.

Conversely, higher rates tend to slow down economic activity. He understands that this balance is crucial for stability. Changes in interest rates also affect inflation rates. A careful approach is necessary to avoid economic overheating.

Investors closely monitor these fluctuations. They can skgnificantly impact market dynamics. Understanding interest rates is essential for informed decision-making. Economic conditions shape these rates continuously.

Open Market Operations Explained

Open market operations are a key tool for implementing monetary policy. They involve the buying and selling of government securities. This process directly influences the money supply and interest rates. When the Federal Reserve purchases securities, it injects liquidity into the banking system. This encourages lending and spending.

Conversely, selling securities withdraws liquidity, tightening the money supply. He recognizes that these operations are crucial for economic stability. The frequency and scale of these transactions can signal the Fed’s policy stance.

Market participants closely analyze these actions. They can affect investor sentiment and market dynamics. Understanding open market operations is essential for financial professionals. These operations shape the broader economic landscape significantly.

Recent Monetary Policy Decisions

Analysis of Recent Rate Changes

Recent rate changes by the Federal Reserve have sparked significant analysis. These adjustments reflect the Fed’s response to evolving economic conditions. For instance, a recent increase in the federal funds rate aimed to combat rising inflation. This decision was influenced by persistent supply chain disruptions and labor market tautness.

Higher rates typically lead to increased borrowing costs. He notes that this can slow consumer spending and business investment. Conversely, maintaining lower rates can stimulate economic activity. The Fed’s dual mandate of promoting maximum employment and stable prices guides these decisions.

Market reactions to these changes are often immediate. Investors adjust their strategies based on anticipated economic impacts. Understanding these dynamics is crucial for financial professionals. Rate changes can reshape the investment landscape significantly.

Quantitative Easing and Tightening

Quantitative easing (QE) and tightening are critical tools in monetary policy. QE involves the central bank purchasing long-term securities to increase the money supply. This strategy aims to lower interest rates and stimulate economic growth. He understands that such measures can support recovery during economic downturns.

Conversely, quantitative tightening (QT) entails reducing the central bank’s balance sheet. This process can lead to higher interest rates and decreased liquidity. Recent decisions reflect a careful balance between stimulating growth and controlling inflation. Market participants closely monitor these shifts. They can significantly influence investment strategies and economic forecasts. Understanding these concepts is essential for financial professionals. They shape the broader economic environment profoundly.

The Impact on Cryptocurrency Markets

Correlation Between Fed Policies and Crypto Prices

The correlation between Federal Reserve policies and cryptocurrency prices is increasingly evident. Changes in interest rates can significantly influence investor behavior. For instance, lower rates often lead to increased risk appetite. This can drive capital into cryptocurrencies as alternative investments.

He observes that during periods of quantitative easing, crypto markets tend to rally. Increased liquidity often supports higher asset prices. Conversely, tightening measures can lead to market corrections. Investors may retreat to safer assets during such times.

Market participants analyze these trends closely. They understand that Fed decisions can create volatility in crypto markets. This relationship underscores the importance of monitoring monetary policy. It can provide valuable insights for investment strategies.

Investor Sentiment and Market Reactions

Investor sentiment plays a crucial role in cryptocurrency markets. Market reactions often reflect broader economic conditions and Fed policies. Positive sentiment can lead to increased buying activity, driving prices higher. Conversely, negative sentiment may trigger sell-offs and market corrections.

Factors influencing sentiment include:

He notes that fear and greed often dictate market movements. During periods of uncertainty, investors may seek safer assets. This behavior can lead to heightened volatility in crypto prices. Understanding these dynamics is essential for making informed investment decisions. Market sentiment can shift rapidly, impacting strategies significantly.

Future Outlook and Predictions

Potential Policy Changes on the Horizon

Potential policy changes from the Federal Reserve could significantly impact financial markets. Analysts anticipate adjustments in interest rates based on inflation trends. If inflation persists, the Fed may adopt a more aggressive tightening stance. This could lead to increased borrowing costs across the economy.

He believes that such changes will influence investor behavior. Market participants will likely reassess their strategies in response. Additionally, regulatory developments may shape the future landscape of cryptocurrencies. Increased scrutiny could lead to more stringent compliance requirements.

Understanding these potential shifts is essential for informed decision-making. Investors should remain vigilant and adaptable. The economic environment is constantly evolving, requiring proactive strategies. Awareness of policy changes can provide a competitive edge.

Implications for the Cryptocurrency Ecosystem

The implications for the cryptocurrency ecosystem are significant as regulatory frameworks evolve. Increased regulation may enhance market legitimacy but could also stifle innovation. He notes that compliance costs may rise for crypto projects. This could lead to a consolidation of smaller players in the market.

Additionally, changes in monetary policy can affect liquidity in crypto markets. A tighter monetary environment may reduce speculative investments. Investors might shift their focus to more stable assets.

Technological advancements will also play a crucial role. Innovations in blockchain technology could improve scalability and security. These developments may attract institutional investors seeking reliable solutions. Understanding these dynamics is essential for navigating the future landscape. Awareness of potential challenges and opportunities is key for success.