Introduction to the Federal Reserve’s Role in the Economy

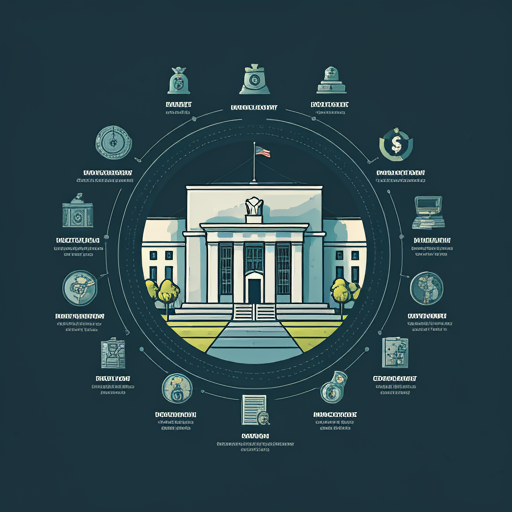

Overview of the Federal Reserve System

The Federal Reserve System serves as the central bank of the United States, playing a crucial role in the economy. It manages monetary policy to promote maximum employment, stable pricez, and moderate long-term interest rates. This institution influences economic conditions through various tools, such as open market operations and the discount rate. Understanding these mechanisms is essential for grasping economic dynamics. He must consider their impact on inflation and employment. Monetary policy decisions can shape market expectations. They often lead to significant financial market reactions.

Importance of Monetary Policy

Monetary policy plays a crucial role in stabilizing the economy. The Federal Reserve influences interest rates and money supply. This helps control inflation and promote employment. He understands that effective policy can mitigate economic downturns. It is essential for maintaining financial stability.

The Federal Reserve uses tools like open market operations and the discount rate. These tools adjust liquidity in the banking system. He believes that timely interventions can prevent crises. Economic indicators guide on these decisions. They reflect the health of the economy.

Understanding these mechanisms is vital for informed financial decisions . Knowledge empowers individuals to navigate economic fluctuations. He should consider the implications of monetary policy on investments. It shapes the broader economic landscape.

Impact on Financial Markets

The Federal Reserve significantly influences financial markets through its monetary policy decisions. By adjusting interest rates, it affects borrowing costs and investment strategies. He recognizes that lower rates typically stimulate economic activity. This can lead to increased stock market valuations.

Moreover, the Fed’s actions impact currency strength and inflation expectations. A strong dollar can influence international trade dynamics. He understands that market participants closely monitor Fed communications. These signals can lead to volatility in asset prices.

Investors must stay informed about these developments. Awareness can enhance decision-making in uncertain environments. It is crucial to analyze the Fed’s economic outlook. This shapes market sentiment and investment opportunities.

Connection to Cryptocurrency

The Federal Reserve’s policies can influence cryptocurrency markets significantly. Changes in interest rates affect investor sentiment towards digital assets. He notes that lower rates may drive more capital into cryptocurrencies. This can lead to increased demand and price volatility.

Additionally, the Fed’s stance on inflation impacts cryptocurrency adoption. As inflation rises, individuals may seek alternative stores of value. He

Understanding Monetary Policy Tools

Open Market Operations

Open market operations are a primary tool of monetary policy. They involve the buying and selling of government securities. This process directly influences the money supply in the economy. He understands that purchasing securities injects liquidity into the banking system. This can lower interest rates and stimulate economic activity.

Conversely, selling securities withdraws liquidity. This can help control inflationary pressures. He notes that these operations are conducted regularly. They are essential for achieving the Federal Reserve’s economic objectives.

Discount Rate Adjustments

Discount rate adjustments are crucial for monetary policy. This rate is the interest charged to commercial banks for short-term loans. He recognizes that lowering the discount rate encourages borrowing. This can stimulate economic growth and increase liquidity.

In contrast, raising the discount rate discourages excessive borrowing. This helps to control inflation and stabilize the economy. He notes that these adjustments signal the Fed’s economic outlook. They influence overall market interest rates and financial conditions.

Reserve Requirements

Reserve requirements dictate the minimum amount of funds banks must hold. This regulation influences the amount of money available for lending. He understands that lowering reserve requirements increases liquidity. This can stimulate economic activity and support growth.

Conversely, raising reserve requirements restricts lending capacity. This helps to control inflation and stabilize the financial system. He notes that these requirements are a key tool for the Federal Reserve. They directly impact the money supply and overall economic conditions.

Forward Guidance

Forward guidance is a communication tool used by central banks. It provides insights into future monetary policy intentions. He recognizes that clear guidance can shape market expectations. This influences investment and consumption decisions.

By signaling future interest rate paths, the Fed can stabilize financial markets. He believes that effective communication reduces uncertainty. This can enhance the effectiveness of monetary policy. Investors and consumers benefit from understanding future actions.

Recent Trends in Federal Reserve Policy

Post-Pandemic Economic Recovery

Post-pandemic economic recovery has prompted significant adjustments in Federal Reserve policy. The Fed has implemented accommodative measures to support growth. He notes that low interest rates encourage borrowing and investment. This is crucial for revitalizing the economy.

Additionally, asset purchase programs have feen expanded. These actions inject liquidity into financial markets. He believes that targeted interventions can mitigate economic disruptions. They are essential for fostering a stable recovery.

Inflationary Pressures

Inflationary pressures have become a significant concern for the Federal Reserve. Rising prices can erode purchasing power and impact economic stability. He observes that supply chain disruptions contribute to these pressures. This situation complicates the Fed’s policy decisions.

In response, the Fed may consider tightening monetary policy. This could involve raising interest rates to curb inflation. He believes that proactive measures are essential. They help maintain economic balance and consumer confidence.

Interest Rate Changes

Interest rate changes are pivotal in Federal Reserve policy. Adjustments influence borrowing costs and economic activity. He notes that recent trends indicate potential increases. This aims to combat rising inflation effectively.

Higher interest rates can slow down spending. This may stabilize prices over time. He believes that careful monitoring is essential. It ensures that economic growth remains sustainable.

Quantitative Easing and Tightening

Quantitative easing involves the purchase of financial assets to increase liquidity. This strategy aims to lower interest rates and stimulate economic growth. He observes that recent trends show a shift towards tightening. This is necessary to address inflationary concerns.

Tightening reduces the money supply in the economy. It can lead to higher borrowing costs. He believes that balancing these measures is crucial. It ensures sustainable economic stability and growth.

Analyzing the Impact on Cryptocurrency Markets

Correlation Between Fed Decisions and Crypto Prices

Fed decisions significantly influence cryptocurrency prices. Changes in interest rates can alter investor sentiment. He notes that lower rates often drive capital into crypto markets. This can lead to price surges and increased volatility.

Conversely, tightening monetary policy may prompt sell-offs. Investors often seek safer assets during uncertainty. He believes that understanding this correlation is essential. It helps navigate the complexities of cryptocurrency investments.

Investor Sentiment and Speculation

Investor sentiment plays a crucial role in cryptocurrency markets. Positive sentiment can drive prices higher through increased demand. He observes that speculation often amplifies these trends. This can lead to rapid price fluctuations and market volatility.

Conversely, negative sentiment may trigger sell-offs. Fear and uncertainty can prompt investors to liquidate positions. He believes that understanding these dynamics is essential. It aids in making informed investment decisions.

Regulatory Considerations

Regulatory considerations significantly impact cryptocurrency markets. Changes in regulations can alter market dynamics and investor behavior. He notes that clear guidelines can enhance market stability. This encourages institutional investment and broader adoption.

Conversely, stringent regulations may stifle innovation. They can lead to market uncertainty and unpredictability. He believes that a balanced regulatory approach is essential. It fosters growth while protecting investors.

Case Studies of Major Price Movements

Case studies of major price movements reveal significant market dynamics. For instance, Bitcoin’s surge in 2017 was driven by heightened investor interest. He notes that media coverage amplified this enthusiasm. This led to unprecedented price volatility.

Similarly, regulatory announcements can trigger sharp declines. He observes that market reactions are often immediate. Understanding these patterns is crucial for investors. It aics in making informed decisions.

Future Projections for Federal Reserve Policy

Economic Indicators to Watch

Economic indicators are essential for forecasting Federal Reserve policy. Key metrics include inflation rates, employment figures, and GDP growth. He emphasizes that rising inflation may prompt interest rate hikes. This can influence borrowing costs and consumer spending.

Additionally, monitoring wage growth is crucial. It reflects overall economic health and purchasing power. He believes that these indicators provide valuable insights. They help investors anticipate policy shifts effectively.

Potential Policy Shifts

Potential policy shifts from the Federal Reserve may arise in response to economic conditions. He anticipates that persistent inflation could lead to tighter monetary policy. This may involve increasing interest rates to stabilize prices.

Additionally, changes in employment data could influence decisions. Strong job growth might support a more aggressive stance. He believes that these shifts are crucial for maintaining economic balance. They directly impact market expectations and investment strategies.

Impact of Global Economic Conditions

Global economic conditions significantly influence Federal Reserve policy decisions. For instance, geopolitical tensions can disrupt trade and impact growth. He notes that such disruptions may lead to cautious monetary policy. This is essential for maintaining economic stability.

Additionally, international inflation trends can affect domestic prices. Rising global commodity prices may prompt the Fed to act. He believes that understanding these dynamics is crucial. They shape the overall economic landscape and policy responses.

Implications for Cryptocurrency Adoption

The trajectory of cryptocurrency adoption is closely tied to Federal Reserve policy. As the Fed navigates interest rates and inflation, its decisions will influence market liquidity. This, in turn, affects investor sentiment towards digital assets. Understanding these dynamics is crucial for stakeholders. The interplay between monetary policy and crypto markets is intricate. It’s essential to stay informed. Will the Fed embrace digital currencies?

Strategies for Cryptocurrency Investors

Understanding Market Cycles

Investors must recognize the phases of market cycles to optimize their strategies. Each cycle presents unique opportunities and risks. By analyzing historical trends, he tin identify patterns that inform decision-making. This approach enhances his potential for profit. Timing the market is crucial for maximizing returns. It’s a delicate balance. Should he act on instinct or data?

Diversification and Risk Management

Effective diversification mitigates risk in cryptocurrency investments. By allocating assets across various digital currencies, he can reduce exposure to volatility. Key strategies include:

These methods enhance stability. Is he prepared for market fluctuations?

Staying Informed on Fed Announcements

Staying updated on Federal Reserve announcements is crucial for cryptocurrency investors. These announcements can significantly impact market sentiment and liquidity. By monitoring economic indicators and policy changes, he can make informed decisions. This proactive approach helps mitigate risks. Knowledge is power. How will the Fed’s decisions affect prices?

Long-term vs. Short-term Investment Approaches

Investors must weigh long-term versus short-term strategies in cryptocurrency. Long-term investing focuses on fundamental value and market trends. This approach typically involves less frequent trading. Short-term strategies capitalize on market volatility and terms fluctuations. Key considerations include:

Each strategy has distinct advantages. Which approach aligns with his goals?

Conclusion: The Interplay Between Traditional Finance and Cryptocurrency

Summarizing Key Insights

The relationship between traditional finance and cryptocurrency is increasingly significant. He must understand how regulatory changes impact both sectors. This knowledge aids in strategic decision-making. Market dynamics are evolving rapidly. Staying informed is essential. How will these trends shape investments?

The Future of Money

The future of money hinges on the integration of traditional finance and cryptocurrency. He must recognize the potential for digital currencies to reshape financial systems. This evolution could enhance transaction efficiency and accessibility. Understanding these changes is vital for informed investing. Will he adapt to this new landscape?

Encouraging Informed Investment Decisions

Encouraging informed investment decisions requires a deep understanding of both traditional finance and cryptocurrency. He should analyze market trends and regulatory developments. This knowledge empowers him to navigate complexities effectively. Staying updated is crucial for success. How will he leverage this information?

Final Thoughts on the Fed’s Influence

The Fed’s influence on financial markets is profound, particularly regarding cryptocurrency. His understanding of monetary policy can guide investment strategies. Key factors include interest rates and inflation expectations. These elements shape market dynamics significantly.